Cash is no longer the primary method of payment for business. Customers demand more varied ways to pay, and businesses must respond accordingly. We discuss the best payment options for small to medium businesses in the article below.

Every payment option comes with a pro and a con. Weighing them up can often prove troublesome. This is because the ones you need are individual to your business and its goals. There is no one-size-fits-all answer. So how do you get the right ones? We dive into payment methods, including their advantages and disadvantages, in the article below.

How important are payment methods?

Choosing the correct payment providers can have a marked impact on your business. You will gain or lose customers depending on the choices you make. Yet accepting all payment options is often not financially viable.

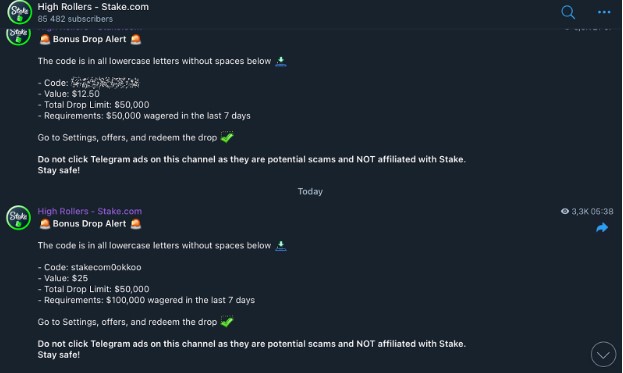

The trick is to find flexibility, and whole sectors have stimulated growth by placing payment at the center of their plan. One of these industries is the iGaming niche, which covers online casinos. Along with several other factors like game options and customer service, payment methods have been integral to its explosive growth over the last few years.

A quick look at some of the highest-ranked providers by casinos.com shows how important it is. Alongside bonuses, offers, and the number of games on offer, payment options are front and center. This is even more vital when companies are working globally. Standard means of banking are not always available in all areas, so alternative methods such as Skrill and cryptocurrencies come into play. Of course, the standard options like Visa and Mastercard exist, but more options are provided. Thus, it shows that payment methods can stimulate growth and push not just a business, but a whole sector, forward.

Selecting major payment methods

There are various pros and cons to using different payment methods. Generally, if you have a physical store, then cash is a must. It remains popular with customers, and it also has no processing fees for you as a vendor. After this, debit and credit card payments are the next big methods of payment. Debit cards have the advantage of immediate fund deduction, which is preferred by many customers as it is easier to manage budgets. However, if you are dealing with global customers, they can have limited international acceptance, so they may limit you somewhat.

Credit cards are better for international customer bases as they are more widely accepted. It is estimated that around 14% of all in-store transactions are made using credit cards. Those with credit cards are also more inclined to make buy now, pay later impulse buys, which can increase your sales. They also have fast turnarounds, providing you with the funds on the same day or in a few business days for online transactions. Of course, the downside is the high fees associated with them.

Over the last ten years, no payment methods have risen as fast as the ability to make mobile device payments. Around 25% of mobile phone users make mobile payments, and most of the population now has some sort of mobile device to hand. Generally, these can be broken down into two camps. The first are digital wallets such as Google Pay and PayPal. They store money digitally and then allow you to transfer it using NFC technology. Second are money transfer apps like XE. Once again, they are both handy for customers but may incur fees.

The major considerations when choosing payment methods

One of the biggest decisions you will have to make when choosing payment methods is the fees. It is no secret that major gateway costs are on the rise and can cut into profits quite substantially. However, choose a platform with low fees, and it may not be as widely used. It is not unheard of to negotiate better deals with these providers, so don’t be afraid to approach them about it.

Start by talking to your customers and looking at the data before installing any payment method. It may not even be something they are interested in. Weigh up the increase in sales and access for customers against these fees to see if they are actually worth it. You also need to be able to integrate it easily into your business methods, such as your software and platforms. If it doesn’t work, then don’t try to hammer a square peg into a round hole.

One of the biggest considerations should be the safety of the payment gateway you are integrating. Any security risks will damage your reputation, so you need assurances from the provider on their protocols. Make sure you check third-party reviews about this and don’t just take their word for it.

Finally, look at what features are included with the payment method. Many have advanced data and reporting features, which can be very useful for accounts and market research. You will also need scalability so that if your business grows, these payment methods can handle the increased demand.

Choosing payment methods is unique to you and your situation. Don’t rush into it. Instead, create a checklist of what you think would benefit your customers, then consult them. From there, you can find the right options and ensure it leads to leads and conversions.

Leave a comment